Reprocessing of medical devices and equipment has gained a lot of attention, not just across hospitals saving millions of dollars annually, but among manufacturers who are seeing it as a means of upping their game and deriving substantial competitive advantage. Reprocessing is a detailed, multistep procedure for cleaning, disinfecting and sterilizing medical equipment. Reprocessed devices are vital to protecting to patient safety and preventing healthcare associated infections (HAIs).

A fact associated with reprocessing medical devices is the savings on healthcare spending. In fact, according to Modern Healthcare, reprocessing medical devices saved hospitals and surgery centers nearly $500 million in 2018.

Rapid spread of the worldwide coronavirus outbreak has given the reprocessed medical devices industry considerable momentum during 2020. Regulatory bodies such as the Association of Medical Device Reprocessors (AMDR) had prioritized the reprocessing of healthcare equipment following a widespread global shortage of medical supplies.

AMDR helps provide healthcare institutions with access to CE marked or FDA-approved reprocessed equipment. AMDR had also noted that the expansion of reprocessing programs could help healthcare providers handle COVID-19 related cost burden, regulate supply chains more efficiently, and better prepare for future threats.

While the COVID-19 pandemic continues to disrupt economies, the increasing amount of medical waste generated is a major concern across the world. This further highlights the need for efficient reprocessing which can not only help meet supply shortages but promote sustainability in healthcare.

According to a recent study by the Fraunhofer Institute for Environmental, Safety, and Energy Technology, the use of reprocessed electrophysiology (EP) catheters can reduce the environmental impact by nearly half compared to a new device.

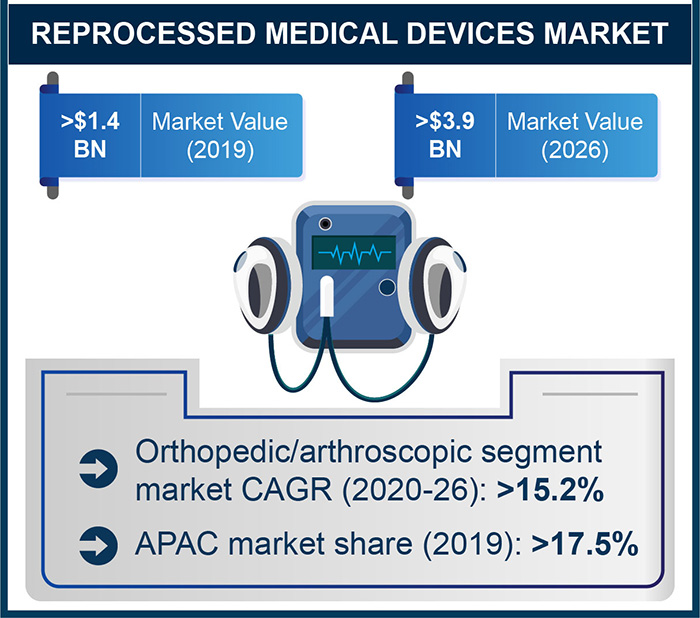

According to a research report by Global Market Insights, Inc., the reprocessed medical devices market is on track to reach a valuation of more than $3.9 billion by 2026.

Focus on Reprocessed Cardiovascular Devices

The safe and effective reuse of medical devices has been a key strategy among hospitals in order to remain profitable despite the increasing cost of new technology. Clinicians, especially in the electrophysiology and catheterization labs, have relied on medical device reprocessors for saving thousands of dollars per device.

In an atrial fibrillation (AFib) case, the device cost is typically about $10,000. Reprocessing just four devices could help bring down the total cost by 30% to around $7,000.

In July 2019, Innovative Health, a leader in reprocessing of single-use cardiology devices, had received the U.S. FDA approval for the reprocessing of Biosense Webster’s PentaRay Nav Eco High-Density mapping catheter. PentaRay is a critical medical equipment in AFib procedures. Hospitals utilizing the reprocessed PentaRay catheter can save thousands of dollars on each AFib cae, making it affordable for a wider patient range.

Innovative Health had also partnered with Acutus Medical back in October 2019 to offer advanced electrophysiology (EP) technology in order to enhance patient outcomes in a cost-effective manner. The two companies announced the partnership to offer healthcare providers a comprehensive range of EP products, including a wide portfolio of reprocessed single-use EP devices from a range of manufacturers.

The reprocessed cardiovascular devices segment captured more than 52% revenue share of the overall market in 2019 and will likely dominate the industry in the future.

Key Challenges and the Future of the Reprocessed Medical Devices Market

Reprocessing, if not performed appropriately, can increase the risk of surgical site infections, complications and HAIs. In order to avoid such accidents, regulatory and public health agencies such as the FDA are taking action to advance the science of medical device reprocessing.

The FDA had issued an updated draft of the “Reprocessing Medical Devices in Health Care Settings: Validation Methods and Labeling” guidance for the healthcare industry. The document highlights advances in technology and knowledge regarding medical device reprocessing. Healthcare providers and reprocessors can use it to improve the safety and effectiveness of reprocessed devices.

Companies in the reprocessed medical devices industry including Innovative Health, GE Healthcare, Medtronic, Stryker, Medline Industries, Vanguard AG, Teleflex Incorporated, and Ethicon, among others, will also need to keep up with changing regulatory scenario.

In August last year, the European Council published the Common Specifications (CS), which provide strict requirements for healthcare institutions across the European Union that will make it unlikely for hospitals to reprocess single-use devices in-house. The CS will be in effect starting May 2021. The AMDR said it supports European Council’s CS. However, hospitals in the region can safely use professionally reprocessed devices from regulated manufacturers, which will help them lower device costs and prevent millions of kilograms of potential medical waste.

When considering the reprocessing of medical devices, it is crucial to mention that various medical industry conglomerates are seeking digital and autonomous solutions for the same. One such player, U.S-based Censis Technologies, in collaboration with Cantel Medical, have recently set their plans of developing an endoscope reprocessing software solution and program. Both the companies have established a joint venture and will attempt to offer improved, unified workflow software solution designed to deliver robust infection prevention from reusable medical devices.

The novel coronavirus pandemic has enhanced the focus on economical healthcare solutions, making reprocessed medical devices a key area of development. Considering the myriad benefits offered, medical equipment makers are working day and night to bring to the global markets some of the prominent devices to tackle the ongoing challenge and to make healthcare more affordable to patients.