Personalized medicine is experiencing a global surge in popularity, with Companion Diagnostics (CDx) products playing a pivotal role in facilitating this expansion. While CDx products are being used frequently in the West for personalized medicine, in the future, providers in Asia will also use more CDx products to determine which drugs will benefit their patients. To date, most CDx products in Asia are used with cancer drugs. However, in the future, CDx products will also be used to help determine the best drugs for infectious diseases, neurological diseases and liver problems, among others. According to Triton Market Research, the CDx market in Asia in 2023 was over $1.4 billion and by 2030, it will grow to over $3.8 billion with a CAGR of about 13%.

While CDx regulations are fairly well-established in the West, CDx regulations in Asia are evolving. Only Japan and Australia currently have detailed registration regulations for CDx. In most other Asian countries, CDx products are registered as IVDs or medical devices. In addition, and very importantly, CDx reimbursement is also evolving in Asia. While drug companies can pay for some CDx products in some cases, without reimbursement in many Asian countries, who and how will CDx products be paid for?

Japan

Japan is the most developed CDx market in Asia from a regulatory standpoint. It has both a regulatory framework and reimbursement scheme for CDx products. According to the PMDA website, from 2013 to 2018, there were about 10 notifications related to CDx regulations. To determine how your CDx product will be registered in Japan, one must first determine its classification. There are a few classification categories for CDx products in Japan—CDx, IVD, and program medical device (SaMD)—but the final classification determination will be made by the PMDA/MHLW. In most cases, PMDA consultations are needed to determine CDx classification, the specific documents required for registration and the appropriate registration route.

There are several options for CDx registration in Japan. First, if the CDx is performed in the West, and the only thing done in Japan is sample collection, it may not require registration. This is the case if the drug can be used in Japan without a CDx. On the other hand, if the drug can only be used with the CDx, registration of the CDx in Japan may be required.

Some CDx products are classified as Software as a Medical Device (SaMD), which is the same as a “program medical device” in Japanese. A program medical device is a program that analyzes patient data fed into a program. In this scenario, a doctor will examine the results of the tests and consider treatment options. Normally, program medical devices are classified as class 2 or Class 3, which require Ninsho or PMDA approval. For example, the FoundationOne test is approved as a program medical device in Japan. In addition, the chance of Japanese reimbursement for a program medical device where the Japanese doctor needs to interpret the test results is very high.

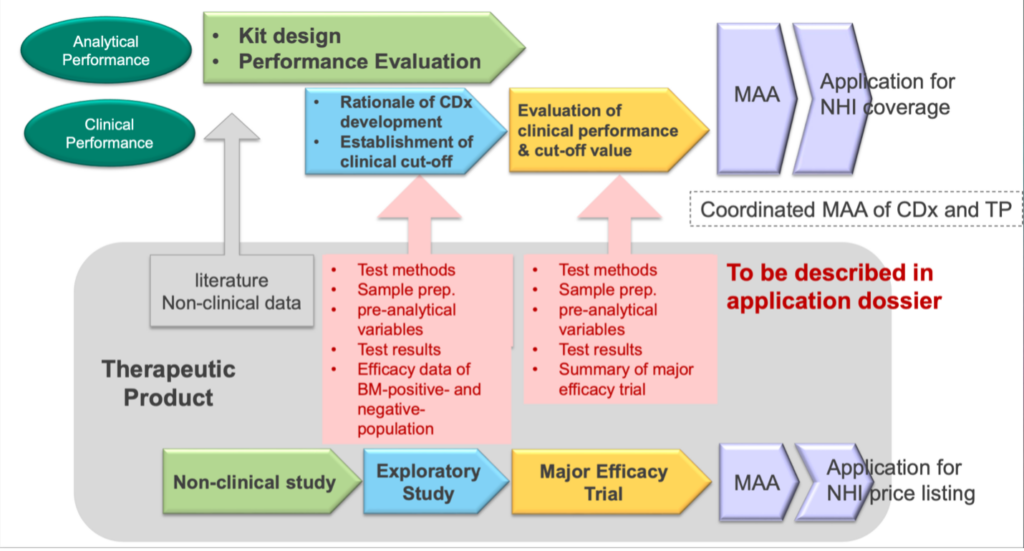

In other scenarios, a CDx product in Japan will be classified as an IVD or CDx. With these classifications, samples will be collected in Japan, the tests will be run in Japan at a local lab and no work will be done overseas. The Japanese doctor will use the test results to aid in their diagnosis. Japan has published lists on the document/requirements for IVD products that must be followed. Generally, the documents/requirements for CDx products closely follow those of an IVD. Also, in December 2013, the Japanese MHLW issued a document called, Technical Guidance on Development of In Vitro Companion Diagnostics and Corresponding Therapeutic Products. In general, the time to register a CDx in Japan as an IVD or CDx product will be about nine months, and the chance of some reimbursement is almost 100%.

In Japan, examples of CDx reimbursement include the Myriad BRACAnalysis and FoundationOne test. The Myriad test is used for breast, ovarian and several other solid cancers for mutations in the BRCA 1 and BRCA 2 genes. The test is registered as a program medical device in Japan (SaMD) and has a reimbursement of 20,200 points or 202,000 Japanese yen.

The FoundationOne test is registered as a Class 3 SaMD product in Japan. This test is reimbursed 80,000 Japanese yen for the test and 480,000 yen for the explanation by the doctor. Therefore, the total reimbursement is 560,000 yen. There is no doubt that FoundationOne and their Japanese Marketing Authorization Holder (MAH) Chugai Pharmaceuticals had to have a lot of strong Japanese KOL support and many consultations with Japan’s Chuikyo to obtain such a high reimbursement. Similar to Myriad, this test is for patients with solid cancer tumors where there is no standard treatment or for those where standard treatment has been completed.

China

Regulations in China for CDx products are still evolving. In general, CDx registration requirements follow China’s IVD and medical device regulations. Product registration for IVDs and medical devices in China takes a long time, about two to three years depending on whether a local clinical trial is needed. It is expected that the Chinese NMPA will come out with new CDx regulations over the next few years. To date, almost all CDx products in China have been for cancer drugs.

There have been a number of guidelines issued for CDx registration in China. For example, in April 2021, a guideline was issued to bring up to date the intended use and specifications of tumor CDx products with respect to similar therapeutic drugs. This guideline titled, Guidelines for Technical Review and IFU Updates of Tumor Companion Diagnostics Reagents based on Similar Treatment Drugs, helped to increase the scope of CDx applications and outlines other relevant information. Also, in June 2022, another guideline titled, Guidelines for Registration Review of Original Companion Diagnostics Reagents Co-developed (Simultaneously) with Anti-Tumor Drugs, came out. This guideline helps applicants write clinical documents for CDx reagent clinical trials developed in conjunction with tumor drugs.

In addition, there have been a number of articles published, including some on the NMPA website, about the use of CDx products in China. One example, published in early 2023 in the Jounral of Molecular Diagnostics and Therapy, discusses the importance of CDx products in China. This article written by three well known Chinese doctors is titled “Current Status of Companion Diagnostic Reagents based on High-Throughput Sequencing Methods.”[1]

Some CDx products that have been registered in China are listed below. They are all Roche Diagnostics products.

Registration Certificate No.: 20213400224

- Product name: Anti – PD – L 1 (SP 142) rabbit monoclonal antibody reagent (immunohistochemical method) VENTANA PD – L1 ( S P 142) Assay

- Scope of application / intended use: This product is used to qualitatively detect the expression levels of the programmed death ligand-1 (PD-L1) protein in formalin- fixed, paraffin -embedded tissue sections. Add to the identification of patients treated with TECENTRIQ® (atentilizumab) for non -small cell lung cancer (NSCLC) at a threshold of 50% TC of any staining intensity (% of PD-L1 expressing tumor cells) or 10% IC of any staining intensity (proportion of PD-L 1 expressing tumor- infiltrating immune cells to the tumor area).

Registration Certificate No.: 20193401504

- Product name: KRAS gene Mutation detection kit (TaqMan fusion curve fluorescence

PCR method) cobas KRAS Mutation Test

- Scope of application/intended use: This product is used for in vitro qualitative testing of formalin -fixed, paraffin -embedded, and human knot straightening Mutations in codons 12,13 and 61 of the KRAS gene in tissue-derived DNA from intestinal cancer and non-small cell lung cancer. The product was not tested in combination with specific drugs, and the detection performance of target gene mutations was validated.

Registration Certificate No.: 20143405095

- Product name: BRAF V 6 0 0 Gene Mutation Detection kit ( PCR fluorescence) cobas ® 4800 BRAF V 600 MutationTest

- Scope of application/intended use: This product is used for in vitro qualitative testing of formalin -fixed, paraffin -embedded human melanin DNA from tumor tissue samples and papillary thyroid cancer tissue samples, BRAF V600E mutations in the extract. The product was not tested in combination with specific drugs, and the detection performance of target gene mutations was validated.

Korea

Korea, like China, does not have its own set of CDx regulations yet. CDx products in Korea are classified as IVD products or medical devices. The Korean IVD Act has two articles specific to CDx registration in Korea – Article 6 (concurrent review on companion diagnostic medical devices and medicine) and Article 7 (clinical performance test, etc.) In the near future, the Korean authorities plan to come out with new CDx regulations. However, even today, the MFDS and MOHW consider CDx products to be very important in deciding the use of a corresponding drug. The MFDS regulates drugs, and it also has detailed information on the label indicating patient eligibility as a result of a particular diagnostic test. Reimbursement for the CDx is granted by the Korean MOHW according to the drug label which has been approved by the MFDS for both the drug and CDx product.

Taiwan

Similar to Korea and China, there are no specific CDx regulations in Taiwan. CDx products in Taiwan are also currently classified as IVDs or medical devices. Thus, CDx products follow IVD and device regulations . Before submitting an approval application for CDx, manufacturers should confirm there is a correlation between the drug indication and the CDx product. Typically, CDx device applications include information such as an application for device registration, free sales certificate, QSD application, approval research reports, etc. In Taiwan, registration of a CDx classified as a medical device or IVD will take less than 1 year for Class 2 products and usually more than 1 year for Class 3 products.

Australia

Besides Japan, Australia has the most advanced CDx regulations in Asia. These regulations are outlined clearly on the TGA website. Generally, the definition of a CDx in Australia closely follows that of the U.S. and EU. Australia’s TGA sees IVD CDx products as In vitro medical devices that provide data for the use of a corresponding drug. The CDx’s IFU should include its use with an appropriate drug. Similarly, the IVD companion diagnostic should be mentioned in the product information for the drug. Generic references to approved IVD companion diagnostics are usually included in the product information.

As mentioned above, the TGA registration requirements for approval of IVD CDx closely follows the U.S. and EU requirements. In Australia, IVD CDx products are classified as Class 3 IVD or class 3 in-house IVDs. The TGA prefers that IVD CDx products and their related drugs are developed simultaneously, and regulatory assessments are done concurrently. If the diagnosis is developed after a drug approval, the registration approval will likely be delayed. The TGA will evaluate the safety and efficacy of the IVD CDx with the validity of the biomarkers. It is also always best to use the IVD CDx during the drug clinical trial for the most efficient registration process. In 2026, the TGA plans to publish a list of approved IVD CDx products on the Australian Register of Therapeutic Goods (ARTG). This list will include both in-house IVDs that have been notified to the TGA as well as commercially supplied IVDs.

Conclusion

Going forward, precision medicine in Asia will continue to grow quicky. As this occurs, CDx usage will also increase. With the development of more fine-tuned therapeutic drugs, acceptance of the benefits of CDx products and increased reimbursement, more Asian patients will benefit. While Japan and Australia have taken the lead on the regulatory front, the other Asian countries will quickly catch up and become bigger CDX players going forward too.

Besides Japan and Australia, which have specific CDx reimbursement schemes in place, in the other Asian markets, CDx reimbursement comes from IVD or device reimbursement. If the CDx and drug can be evaluated for registration together, there is normally a higher chance of reimbursement. Asian key opinion leaders (KOLs) are oftentimes influential in CDx reimbursement. In some cases, drug companies will pay for their own for corresponding CDx tests to hasten entry into an Asian market. To increase CDx reimbursement in Asia, local studies showing their cost effectiveness and superior patient outcomes will need to be increased.

References:

[1] Li Ran, Fang Li, Xu Chao. Current status of companion diagnostic reagents based on high- throughput sequencing methods [J]. Journal of Molecular Diagnostics and Therapy, 2023,15(03):541- 544.DOI:10.19930/j.cnki.jmdt.2023.03.018.