Regenerative medicine is most commonly defined as a process or application of a material, device or therapeutic that repairs, replaces or regenerates cells, tissues or organs. The value of the market, which includes stem cell therapy, tissue engineering and biomaterials, is expected to reach $6.5 billion by 2019, according to a recent report by Transparency Market Research.

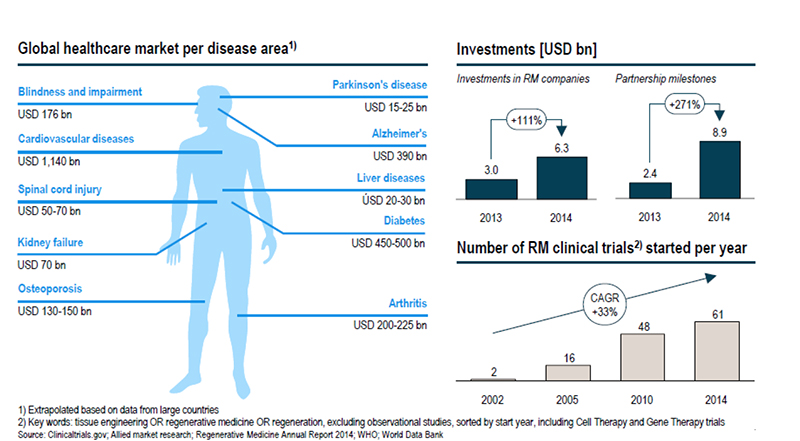

Today’s medical treatments generally serve as a palliative remedy, with treatment following a health event or the discovery of a condition. Regenerative medicine holds the promise of solving acute problems by healing and restoring functionality within the body. And why not use it to stop degeneration from happening in the body at all? No longer an abstract concept, regenerative medicine aligns with today’s healthcare cost containment environment by focusing on prevention and/or serving as a long-term solution. With that presents a major economic opportunity, says Bert Kip, CEO, Brightlands Chemelot Campus, an innovation center in Geleen, Netherlands that works with start-ups, institutes and researchers in the medical field. Kip adds, however, that the field faces challenges both in pushing palliative care into prevention and technology scale up.

Across the world, more than 670 companies are involved in regenerative medicine in some way, and more than half of them fall within therapeutics and devices. A lot of these companies are looking at investing in the emerging markets of the Asia Pacific, including China, Japan, South Korea and India, according to Transparency Market Research. Bone and joint reconstruction is a key application area within these regions due to the increasing aging population. According to information provided by the Alliance for Regenerative Medicine (ARM) in its state of the industry update this week, 20 regenerative medicine products were approved worldwide in 2015. Of the 631 clinical trials last year, oncology and cardiovascular were the largest categories, with more than 40% of trials involving oncology therapeutics and more than 12% involving cardiovascular applications.

The true success of regenerative medicine hinges not only in translating the technology concept into a viable and concrete solution but also on the collaboration between all parties within the healthcare ecosystem, from researchers, biotech, drug, and device companies to investors, the government, and payers. Of the $10.8 billion raised in the regenerative medicine last year, $806.8 million fell into the tissue engineering category, which hits the most relevant segment in which device manufacturers are involved (other categories: $6.8 billion for gene and gene-modified cell therapy and $7.0 billion for cell therapy). The top two sources of financing came from mergers and acquisitions, and corporate partnerships.

Aside from technology development, there are several issues facing the progress of regenerative medicine, from global reimbursement issues and coding policies for these products to ethical issues. ARM indicates that the 21st Century Cures Act could bode well for the field, as it intends to provide accelerated approval for regenerative medicine products.