More resources, expertise, and technology, please!

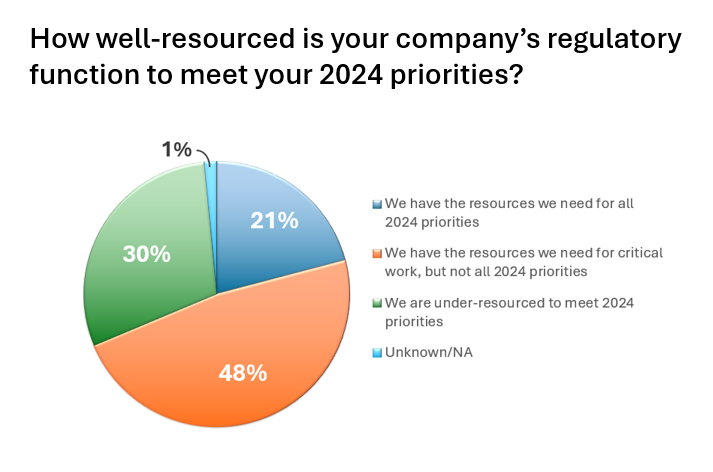

The common theme illustrated in a recent survey among medical device regulatory professionals is the need for increased resources, expertise, and technology. The data validates industry concerns of increasing workloads and overtime hours, and how many companies are finding it hard to recruit suitable skilled RA/QA associates. Many medical device companies are questioning their regulatory competencies and resource availability due to increasing complexity and changing compliance requirements.

Regulatory Fatigue…are we there yet?

The April 2024 survey among medical device companies illustrates an industry rapidly headed toward regulatory fatigue due to resource constraints, ever changing global policy, and an underutilization of technology/digital process. The survey was conducted by online media company, MedTechIntelligence.com in partnership with regulatory services and solutions provider, Celegence.

Summary of Findings:

- Gaps in achieving regulatory requirements are overwhelming medical device makers.

- The need to mitigate risk is increasing with the growing complexity of global compliance.

- MDR/IVDR remains a top priority for focus and investment.

- Companies lack bandwidth, yet organizations are cautious to employ external resources due to their preconceived ideas about outsourcing.

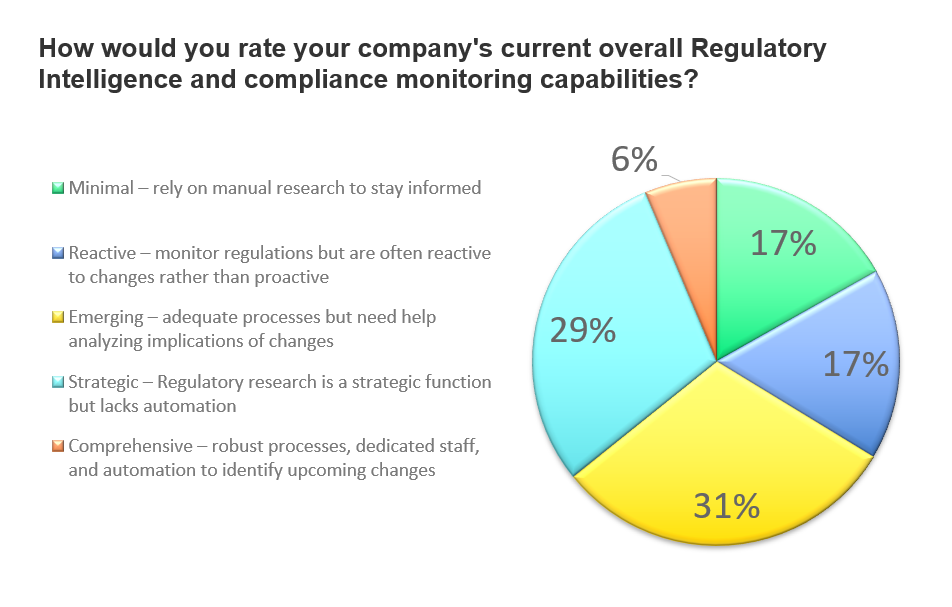

While just more than 1/3 of respondents feel regulatory intelligence and compliance monitoring capabilities within their organizations are strategic and comprehensive, 65% rank overall capabilities as emerging, minimal, and reactive. They rely heavily on manual research and are often reactive to changes rather than proactive to managing compliance.

Only 6% of all respondents say their regulatory expertise and compliance processes are comprehensive while nearly 1/3 report they have adequate processes but may not fully comprehend the implications of changing requirements. In overall response, the indication is an industry in need of more regulatory resources, expertise, and technology. The survey further explores these needs, where the gaps remain, and where additional assistance is most beneficial.

Get the full Executive Summary Report

Watch the panel discussion: