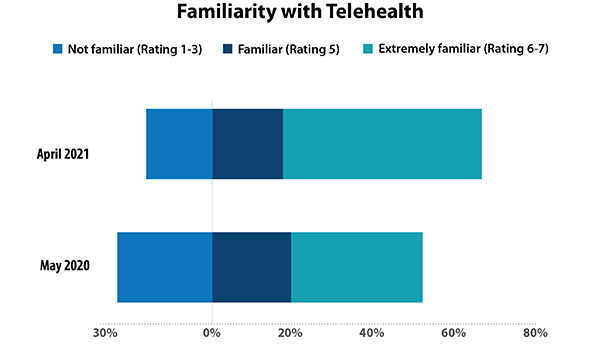

The COVID-19 pandemic has forever changed the trajectory of virtual care. The pandemic has dramatically boosted the market for telehealth services—consumers now understand what it is and how to access services. According to our research, as of April 2021, two-thirds of respondents are familiar with telehealth services compared to just 50% in May of 2020. Consumer-reported use of telehealth services has also increased from 15% in Q2 2019 to 64% in 2021. The market for remote health technology products and services has accelerated 5–10 years beyond expectation.

The pandemic has driven this increased usage. Parks Associates research shows that one-third of telehealth service users report their doctor would only see them virtually. It is also important to note that children are a key driver of use, as 82% of respondents with children in the home report using telehealth instead of just 51% of households without children. This forced familiarity with virtual care has laid a foundation for continued growth in the market. Consumers who have gained familiarity with telehealth services are more likely to reach for it again in the future when needed.

The market dynamics for telehealth and virtual care continue to evolve. Over the past two years, one of the significant shifts in telehealth models has been the route by which services are accessed and delivered. Before the pandemic, 41% of telehealth users reported their last visit was to a national service such as Teladoc, while only 13% reported using a service from a local care provider.

Today, nearly 50% report their last visit to a local provider, while just 18% report last using a national service. Local care providers and systems are leading the charge in telehealth—as are the software and services solutions providers enabling them. Our prior research finds that consumers strongly prefer to talk to their physician, not any physician. Now that this is a reality for many, consumer willingness to use telehealth has grown dramatically.

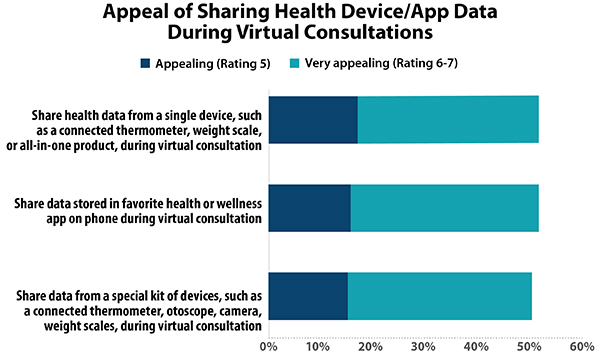

The role of devices in at-home care is also evolving. Parks Associates research shows that connected health device adoption jumped dramatically from 42% in 2020 to 55% in 2021. The adoption of smart watches, smart thermometers, connected pulse oximeters, and blood pressure cuffs all grew substantially. Consumers seek to share health device data with their care providers; however, current telehealth consultations for urgent and primary care visits typically lack any real-time vital sign data, limiting the depth of insight and the potentially treatable conditions via virtual modalities. Though it’s rare now, integrating health device data with remote care services is on the horizon. RPM and hospital-at-home programs are leading the way by provisioning devices to patients, but there is also an opportunity to provide similar integrations for primary and urgent care telehealth visits.

In the short run, with the delta variant and staff shortages continuing to put pressure on hospital capacity, virtual care remains a critical component of health systems’ overall strategies. One key challenge is the forced and slapdash manner in which systems and providers moved to these solution—systems were essentially forced to operationalize virtually overnight, and many were not able to take the time to evaluate best practices and formulate detailed and effective strategies.

In the long run, as the virtual care market rapidly adapts and scales to meet urgent demand from providers and health systems, it is critical for virtual care ecosystem players to understand how consumers have experienced these changes to better position themselves and design their solutions. Consumers’ experience with virtual care has changed their expectations for the future of healthcare delivery and point to the opportunities and challenges that lie ahead.