Breast cancer is the most commonly diagnosed type of cancer and the second leading cause of death among women, as evident from stats revealed by the National Breast Cancer Foundation. As awareness of breast cancer has grown, the number of women undergoing breast screening has also increased. This has propelled the demand for automated breast ultrasound systems (ABUS) in hospitals and diagnostic centers. ABUS enables physicians to screen women, especially with denser breasts, and provides superior image quality, giving the products a competitive edge over handheld ultrasound systems (HHUS).

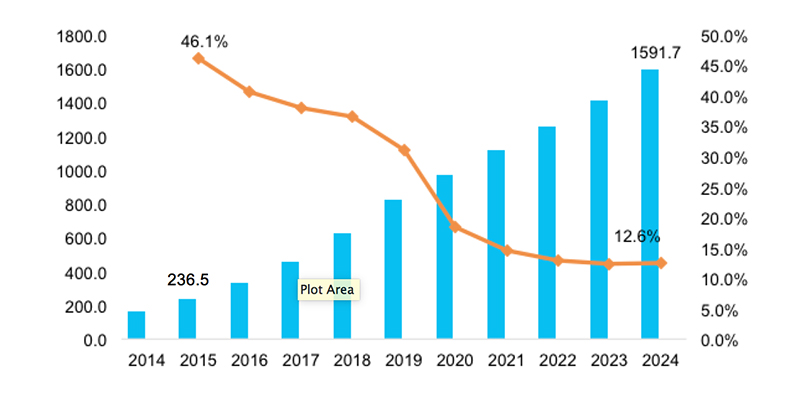

The global automated breast ultrasound systems market was valued at $236.5 million in 2015 and is expected to expand at a CAGR of 21.6% during the forecast period between 2016 and 2024 (see Figure 1).

ABUS Screening

ABUS are FDA approved for screening in conjunction with mammography for dense breasts. Radiologists are inclined towards adoption of ABUS, as they provide high quality 3-D images. Surgeons are adopting this system for pre-operative evaluation of breast to accurately identify the tumor size and location. HHUS are mainly preferred for preoperative evaluation as compared to ABUS, due to the high cost associated with ABUS and the lack of skilled radiologists who can operate the ABUS system during the crucial preoperative period.

Driving Demand for ABUS in Developed Countries

Factors attributable to the growth of ABUS in North America and European markets include increased patient awareness, high uptake of early breast screening, and availability of funds to install relatively expensive ABUS.

- According to the World Health Organization, 232,924 new cases of breast cancer were diagnosed in 2013. Moreover, the American Cancer Society estimates that until 2016 there were more than 2.8 million breast cancer survivors in the United States.

- According to the Cancer Research UK, the incidence rate of breast cancer in the U.K is expected to rise by 2% from 2014 to 2035.

- Public Health England launched a campaign called ‘Be Clear on Cancer’ (2015) to raise breast cancer awareness among women over 70 years old. Moreover, research and development in the field is encouraged through the Breast Cancer Now Catalyst Programme (2016).

High prevalence coupled with government awareness are driving demand for ABUS in the United States and U.K.

Technology Drivers in Asia-Pacific Region

The Asia-Pacific region has immense revenue potential for the growth of ABUS market. Demand for ABUS in Asia-Pacific in terms of volume is expected to increase at a CAGR of 24.4% during between 2016 and 2024. Lack of awareness had deterred the uptake of early breast screening until ABUS manufacturers and non-profit and regional cancer organizations undertook various cognizance initiatives. Some noteworthy initiatives include The Pink Initiative organization in India, Breast Cancer Initiative East Africa, Inc. and Pink Ribbon Breakfast initiative by Cancer Australia. In addition, denser breast tissue in the Chinese population is driving demand for ABUS in China at a rapid pace.

ABUS Manufacturers Increase Footprint

Market leaders have followed a strategic inorganic growth roadmap. For instance, GE Healthcare acquired U-Systems, Inc. in 2014 to expand its breast care innovations portfolio. Philips partnered with SonoCine, Inc. in 2014 to provide ABUS imaging for its ultrasound systems. Hitachi Aloka Medical America, Inc. entered into a strategic alliance with iVu Imaging Corp. in 2014, gaining exclusive distribution rights for iVu’s SOFIA (ABUS) system in North America. This agreement helped iVu Imaging access the expanded channel and also helped both the companies to leverage the technical expertise of the other, which further improved the performance of SOFIA.