What do air-traffic control and medical device regulation have in common? Both are strictly regulated on national and international levels, and both manage the safe and orderly flow of product from beginning to end – takeoff (submission), landing (approval) and en-route navigation (compliance management). Regulatory affairs teams are the control towers of medical device commercialization, looking for clear flight patterns amid standards, guidance documents, and changing compliance regulation while searching for that safe landing at approval.

While the specifics of their operations differ, the overarching goals of ensuring safety, managing risks, and complying with stringent regulations are common to both medical device regulation and air traffic control…and both can be highly stressful working environments. In 2020, Forbes published: The Most Stressful Job In The World? What it’s Really Like To Be An Air Traffic Controller. A 2024 list of most stressful jobs by MastersDegree.net placed Compliance Officer as the #2 most stressful job, with a 60% burnout rate.

Navigating changes in the global regulatory landscape is like navigating the trainyards at Grand Central Station, Gare du Nord, and Howrah Junction. Continual new guidance documents, shifting compliance regulations, and global regulatory bodies attempting to ‘harmonize.’

A recent survey conducted by MedTech Intelligence, in partnership with regulatory consulting firm, Celegence illustrates how growing complexities with MDR regulations and related global compliance updates may be leading many medical device regulatory professionals to a point of potential burnout. According to Ibim Tariah, Technical Business Development Director at EU notified body, SGS, current resource constraints are due in part to significant regulatory change seen over the past several years. For example, he says the 2017 European Commission released MedDev 2.7/1 revision 4 was released as guidance and an early warning the new MDR was just around the corner. He suggests, “Manufacturers that did not heed the warning are struggling today.” The 2024 MTI Regulatory Report 2024 released this month echoes Tariah’s comment.

The survey data overwhelmingly suggests quality and regulatory resources throughout the industry are being stretched much too thin, leading to potential burnout, non-conformances, higher costs, and potential patient harm.

In overall response, the survey reports ‘Time/Bandwidth’ as the top medical device regulatory challenge faced during 2024 and illustrates the industry-wide regulatory fatigue being driven by changing global compliance regulations in recent years. “There’s a gap in the work that needs to be done and the resources available to do it,” says Erin Cosgrove, VP, Business Development – Medical Devices, Celegence, “and the gap is not getting smaller.”

Dr. Pratibha Mishra, Senior Manager – Medical Device Services at Celegence, agrees with Cosgrove. “A lot of big and small [medical device] markets have seen changes in the regulations that apply to these devices,” she says, “and the speed with which the manufacturers have to comply with them has also accelerated.” Mishra also suggests some manufacturers may have just started late while others are simply struggling to adapt to the added complexities of new compliance requirements.

The second leading overall challenge declared by respondents in the 2024 regulatory survey (total selected as #1 or #2) is ‘Costs/Managing Budget.’ When looked at individually, however, respondents rate it the #1 Challenge with 32% of survey takers citing it as their #1 challenge, slightly ahead of the 27% reporting ‘Time/Bandwidth.’ Collectively, Ninety percent of all survey takers chose Time/bandwidth and Costs/managing budget the two top challenges for the year.

Highly skilled internal teams still need additional expertise

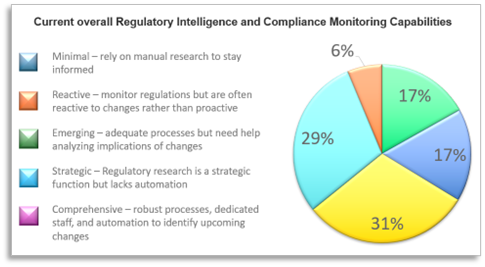

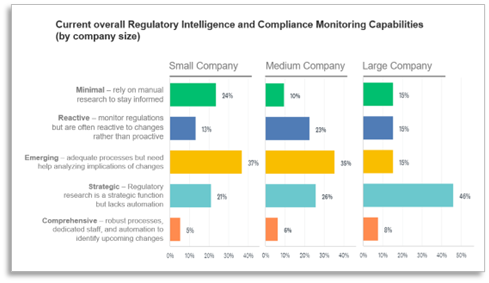

In general, most medical device manufacturers received good ratings for overall regulatory capabilities and expertise by the survey respondents. Half or more of the industry regulatory professionals surveyed feel their organizations have above average regulatory expertise, knowledge of changing global requirements, and IVDR/MDR maintenance requirement skills. When asked about current overall Regulatory Intelligence and compliance monitoring capabilities, however, a little more than a third (35%) report their regulatory intelligence and capabilities as ‘Robust’ or ‘Strategic’ while 65% say their overall they are ‘Emerging, Reactive or Minimal.’

Predictably, the survey found large Medical Device companies to be more strategic and comprehensive than smaller organizations. More than half of respondents working for large device makers rate their overall organization as Strategic or Comprehensive while only a third of survey-takers at small/medium firms feel the same.

Nearly 1/4 of small firms (most with less than 5 devices in market) say their organizations have Minimal Regulatory Intelligence and Compliance Monitoring Capabilities; half claim to be Emerging and Reactive. “There is just more to be done now in terms of documentation and maintaining compliance of devices already on the market,” say Mishra, “and there are a lot of changes in the regulatory world – EU MDR, China in the last 5-6 years, and recent changes in South European regulations. A lot of big and small markets have seen changes in the regulations that apply to [medical devices], and the speed to which manufacturers have to comply with them has also accelerated.”

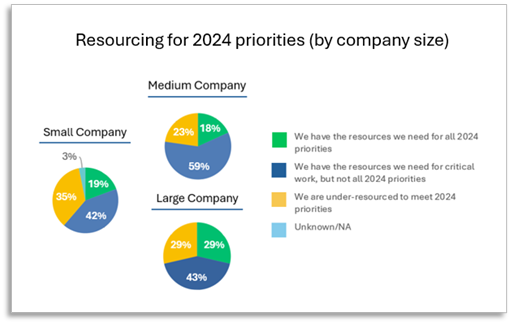

The survey also reveals 3 out of 4 regulatory teams surveyed believe they have large gaps in necessary resources to complete regulatory priorities. Fortunately, 69% say resourcing necessary for their critical work is sufficient, yet sizable gaps remain for many device companies relative to completing 2024 regulatory priorities.

Although 3/4 of respondents industry-wide say their company is under-resourced, survey takers working at large medical device manufacturers report being better prepared to meet their priorities. Nearly 1-in-3 large company respondents report they have the resources needed to complete all priorities, yet less than 1-in-5 small and medium device makers are fully resourced for all priorities, according to the survey.

Eighty-two percent of respondents working for medium size medical device companies report being limited in resources to complete 2024 priorities. Nearly a quarter of medium company associates feel they lack sufficient resources to meet all priorities, yet 59% say they are resourced well enough to complete critical priorities.

Only one-in-3 small device makers report they are under-resourced to complete 2024 priorities. “There is no doubt about it,” Tariah stated, “MDR has put a large burden on the industry…disproportionately on small/medium manufacturers.”

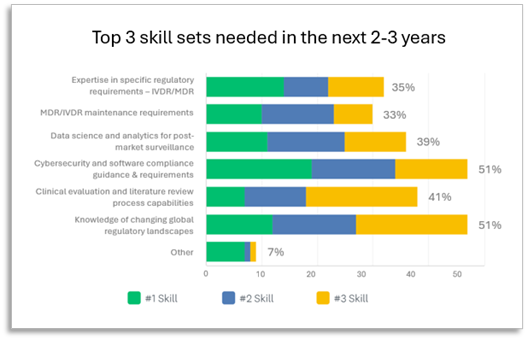

Overall, increasing knowledge of the changing global regulatory landscapes and cybersecurity are the top skill sets device manufacturers are planning for in the next 2-3 years. A third or fewer rate data science, cybersecurity, and software compliance as areas of expertise among their current resources, and the research shows expertise in cybersecurity is identified as both, the greatest need and the lowest current skill set. Data science and analytics for post-market surveillance is the second lowest ranked organizational skill set among respondents overall, yet it is not reported as a Top 3 key skill set for internal professional development or acquisition in the next 2-3 years.

While there is indication of increased budgets to help mitigate the challenges of regulatory management, most believe some combination of internal resource development, partnering with highly skilled outside services, and advanced technologies is needed to provide the necessary industry relief and assure safe, compliant medical devices globally. How technology and outside services can help will be further explored in part 2 of the Medical Device Regulatory Report 2024. Watch for more of this continuing series in the next MedTech Intelligence newsletter or on MedTechIntelligence.com.