Step 2: Requirements

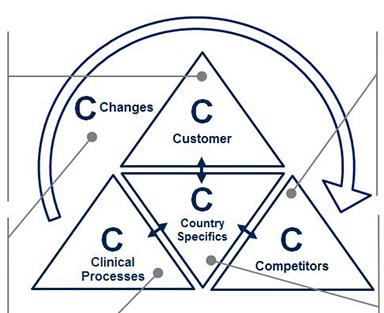

After profiling the market, it is necessary to understand the requirements for new market success to complement and refine the market understanding formed in the first pre-analysis step. Companies may easily uncover these key requirements by initiating an open dialogue with market participants. Key industry experts in research or academia often have visionary ideas on the future of medtech, and they may point to the short and long-term market trends (e.g., upcoming technologies, new regulations). Key decision makers (e.g., lab directors and managers for diagnostic devices) and operative users (e.g., lab technicians and biotechnical assistants), on the other hand, can complement this information with their professional experience, overseeing key decision making. Overall, expert discussions are most valuable in determining market success factors when addressing following questions:

- Market Entrance Hurdles. What hurdles must be overcome to successfully enter the market? Entrance hurdles concentrate on common market challenges but also overall competition in the targeted market. Hurdles might be strict regulations for new products (e.g., FDA regulations) or overly strong local competitors (e.g., local market dominated by an established player).

- Willingness-to-Pay and Competitor Costs. In the diagnostics segment, willingness-to-pay for testing is often directly related to reimbursement rates. Operating costs for similar or close competitor products may additionally set the standard (e.g., costs for autoimmune testing might be assumed as standard for bone metabolism testing). Combining the insights from the expert interviews with those from secondary research may provide a clear initial willingness-to-pay estimation.

- Must-Have and Outstanding Features. Must-have features address the current industry and product needs, differentiating according to country (e.g., reliability, ease of use). Outstanding features, on the other hand, focus on the industry and product wants (e.g., full system connectivity, excellent service). This insight can be helpful in identifying an appropriate market positioning strategy for the new product/ market entry. Of course, customers’ evaluations likely differ across customer types.

- Pain Points and Unmet Needs. In addition to expert, customer interviews, end-customer interviews (e.g., patients) also help reveal pain points of current product solutions and unmet needs not addressed by any other products yet, thus, providing potential leverage for high differentiation.

Step 3: Evaluation

Following profiling and requirements, evaluation of the market potential and launch success probability completes the depiction of the new market’s attractiveness. This final step provides quantitative and qualitative results and ensures secure and informed decision making.

- Quantitative Estimation. A market potential estimation is crucial for deciding if revenue expectations are possible. To achieve this, upper and lower price limits as well as the average willingness-to-pay for the respective product/market will be used. This information will be complemented with market figures from secondary research (e.g., number of customers per customer type, used devices) and a quantitative forecast, including present and predicted future trends to estimate the market development. After the completion of the first two pre-analysis steps, this information should be readily available. For accurate validation of the assumptions, the fairly reliable predictions of market experts are essential.

- Qualitative Evaluation. The qualitative evaluation integrates all insights about the potential product and/or market for a go or no-go recommendation of product development and market entrance. Here, various scoring models may be used; for instance, a scoring model that prioritizes country specific effects (e.g., market levers), as well as opportunities and threats (e.g., local regulations, competitor strength) with achievement potential ratings according to the company’s strengths and weaknesses (e.g., fast research and development capabilities, existing technology experience) can be applied.

Pre-analysis Provides Necessary Transparency in Advance

As medtech continues to evolve and the market demands more innovation, companies must find effective ways not only to meet but even exceed expectations. Through the pre-analysis, companies will gain industry transparency via profiling, clear customer needs through requirements, and valid financial forecasts for potential innovation in evaluation.

In the initial example of the medtech company that developed the electrosurgical device, a pre-analysis would have confirmed the company’s initial understanding that there is an enormous market potential for tissue-selective surgical cutters. However, the pre-analysis would have also uncovered the fact that surgeons consider “ease of use” as a must-have feature—a critical component that was hindered by the devices long learning curve and impairing vision in surgeries.

A complete pre-analysis should take no longer than two to three months from start to finish. Compared to years of product development, this is a worthwhile time investment to fully capitalize on medtech innovation. Through the pre-analysis, medtech managers will be prepared to make sound decisions, save costs and increase return on their investment.