Cardiovascular diseases or CVDs have long been considered among the leading pain points of the medical industry. With conditions like stroke or IHD (ischemic heart disease) contributing heavily to mortality and disability worldwide, cardiovascular devices and their significance in heart-related therapies is rapidly being brought into the spotlight.

Fatalities caused due to CVDs have been rising steadily over the years. According to a study in the Journal of the American College of Cardiology that focused on reviewing the overall magnitude of the trends and burden of CVD over three decades, cardiovascular diseases accounted for nearly one-third of all deaths across the globe in 2019.

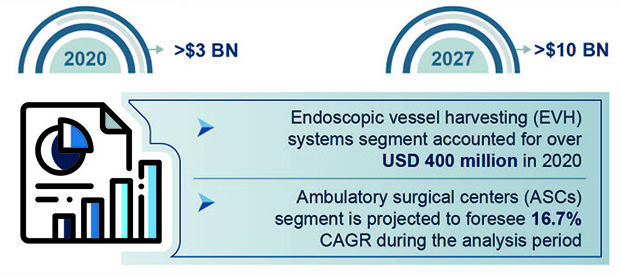

These alarming statistics are testament to the fact that nations worldwide need to implement cost-effective health programs and therapies designed to mitigate risk of CVDs. Development and deployment of effective and advanced medical devices is a key part of these efforts. It is expected to contribute to the growth of the cardiovascular devices market size, which is set to exceed $10 billion by 2027, according to Global Market Insights, Inc.

Move Towards Minimally Invasive Treatment Solutions

Minimally invasive surgical procedures, especially in the cardiovascular discipline, have continued to gain favor over the years due to myriad benefits like minimal damage to the body, less pain, and lower risk of complications as compared to open surgeries. Initially brought to light in the mid-90s, the MIS procedures followed the performance of the first coronary artery and heart valve bypass using minimal access routes.

The preference for minimally invasive procedures is driven by advancements in cardiovascular medical device technologies. These developments are instrumental in positioning less invasive procedures as the operating method of choice, owing to the fact that they rely heavily on the use of catheters and other specialized medical equipment designed to be inserted into the body through small incisions, for therapeutic interventions and diagnostic measurements.

For instance, novel innovations like smart balloon catheter systems, are equipped with electronics, sensors and mechanisms. They are consistently redesigned in an effort to deliver ablation therapy, blood flow data, hematological data and electrical stimulation through a single device.

In September 2020, a team of researchers led by engineers at Northwestern University and George Washington University designed a balloon catheter system. It was equipped with flexible and stretchable matrices of electrode actuators and sensors as well as pressure and temperature sensors. These are often used in minimally invasive ablations or surgeries to treat conditions such as heart arrhythmias.

Escalating Risk of Atrial Fibrillation among COVID-19 Patients

The most common symptoms associated with COVID-19 disease are flu-like symptoms such as dry cough, fever and body aches. While initial reports focused on the respiratory impacts of the disease, recent studies have started to shed light on various heart-related complications arising in nearly 10–20% hospitalized COVID-19 patients, most notably atrial fibrillation.

For example, a study led by University of Pennsylvania-based researchers revealed that COVID-19 patients admitted to the ICU were 10 times more likely to experience considerable heart arrythmias. Atrial fibrillation, especially, was detected in almost 19–21% of all COVID-19 cases.

This has shed light on the rising importance of cardiovascular medical devices as key therapy solutions for emerging heart-related conditions during the pandemic. Major players like Medtronic are taking persistent efforts to address the need for advanced cardiac devices. Just last month the company announced that it had conducted the primary procedures in the Pulsed AF AFib treatment trial.

The investigational device exemption (IDE) was aimed at examining the PulseSelect PFA (pulsed field ablation) device that utilizes pulsed electric fields for the treatment of atrial fibrillation. Cardiologists from the Ohio State University Wexner Medical Center were the first in the United States to perform a procedure using the system in February 2021, following which it was performed successfully on 13 more patients across the globe.

Preliminary results from the pilot Pulsed AF study were revealed at the Heart Rhythm Society 2020 Science, along with additional evidence revealed at the AF Symposium earlier in the year, which showed a 100% acute efficacy rate, and no device or procedural related events in the pilot patient cohort treated with PulseSelect.

Emergence of Sophisticated and Innovative Cardiac Ablation Devices

As the burden of cardiovascular ailments on the global medical domain continues to grow over the years, the adoption of advanced treatment technologies will witness a significant upsurge, creating lucrative growth avenues for the cardiovascular device industry in the years ahead.

Cardiac ablation devices accounted for almost 72% of the cardiovascular devices market share in 2020 and are expected to gain massive momentum and, as per GMI estimates. The rising prevalence of atrial fibrillation is a major contributor to the popularity of these devices. The products are addressing an ever-increasing demand for minimally invasive ablation procedures and innovation in cardiac ablation device technologies.

For example, in June 2020 Boston Scientific introduced the DIRECTSENSE technology in the United States, as a tool designed to monitor the impact of radiofrequency energy delivery during cardiac ablation processes. Approved by the FDA in April 2020, DIRECTSENSE was hailed as the only tool that can track fluctuations in electrical resistance, or local impedance around the INTELLANAV MiFi Open-Irrigated (OI) ablation catheter tip, giving medical practitioners an additional solution for therapy effect measurement during ablation procedures.

The evident reinforcement of cardiovascular devices market is hinged on a key factor—the risk of CVDs and related health problems is recognized today on a greater scale. It can be attributed to a growing healthcare awareness through visibility on the internet, private hospital heart programs and public outreach programs from government agencies like the CDC. Consumers are alert towards the symptoms of developing a heart disorder, the need to early diagnosis and available treatment options. The fast expanding geriatric population base will only fuel the potential of medical devices sector.