In recent years, there has been a significant amount of investment in the telehealth space—$3 billion this year and projected to reach $25 billion by 2025. And the global COVID pandemic is further accelerating the growth in the on-demand healthcare services space.

The Department of Health and Human Services (HHS) reported that “at the start of the COVID-19 public health emergency (PHE) in 2020, with stay-at-home orders in place and warnings on the risk for severe illness from COVID-19 increasing with age, Medicare FFS [fee-for-service] in-person visits for primary care fell precipitously in mid-March. It then found that in April, nearly half (43.5%) of Medicare primary care visits were provided through telehealth compared with less than one percent (0.1%) in February before the PHE.” And while the pandemic acutely exposed the need, many analyzing of the space agree that the popularity of virtual care is likely here to stay.

And with the rise in the demand for virtual care comes the need for more readily accessible patient-monitoring solutions. This is where the next generation of consumer wearable devices comes into play.

Wearable Sensors Meet Remote Patient Care

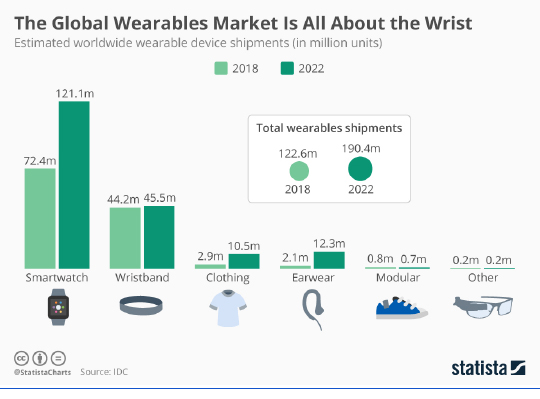

In remote patient management and delivery of care scenarios, wearables offer the potential for real-time data collection, increasing care provider accuracy and informing decision-making. A 2019 Pew Research Center study reported that 21% of U.S. adults surveyed say they regularly wear a smartwatch or wearable fitness tracker. The global number of devices is expected to surpass one billion by 2022, according to Statista.

In recent years, much has been made of the proliferation of higher-quality, consumer-grade sensors that miniaturize things like ECG, blood pressure and heart rate and incorporate them into daily-wear items such as watches, eyewear, earbuds and rings. This category of devices purports to conveniently combine the benefits of passive capture of real-time health data for preventative, self-managed care with common mobile-lifestyle needs such as messaging, entertainment, and general productivity (for example, the Apple Watch Series 6 blood oxygen monitor).

A key part of improving patient outcomes are timely interventions. The underlying motivation to pursue virtualized intervention methods is driven by a real need for more informed preventative contact that identifies and diagnoses negative health indicators, intercepting at the earliest conceivable moment. To achieve this, telehealth providers need access to a rich stream of high-quality data at the outset of a virtual visit. To go from consumer to medical grade, the overall capture and reporting quality of many of the industry’s leading wearable device manufacturers will need to increase significantly to adhere to higher regulated standards. For example, the kind of variability of sensor readings seen in fitness trackers in past clinical studies are nonstarters to qualify for medical-grade designations or uses.

Introducing Medical-Grade Lifestyle Devices

Why is this important? Traditional medical device manufacturers generally demonstrate a good grasp of distribution, integrity and privacy, but often are insufficient at inspiring the sort of passion that can drive patient adoption and adherence—due to complex setup or otherwise non intuitive usage experiences. Whereas, consumer manufacturers are often far better at creating the sort of product engagement that can correlate with strong adherence behaviors—making products people love.

By blending the best-of-breed capabilities of both medical and consumer-grade manufacturers, a new class of device is possible: Medical-grade lifestyle devices. Combined with virtual care, providers can readily keep track of their patients to improve the quality of care, while patients are empowered to improve their health.

A new class of device is possible: Medical-grade lifestyle devices. Combined with virtual care, providers can readily keep track of their patients to improve the quality of care.

This is not easy; otherwise, there would be more direct examples to point to rather than just analogs. Beyond the complexity of balancing the parallel needs of patients and care providers, there’s also the added challenge of an understandable amount of medical professional skepticism due to the numerous high-profile failures of consumer tech companies attempting to enter the near-medical space. To deliver on the promise of improved patient care, it is important to identify the key factors that resulted in previous unsuccessful attempts and outline how to close those gaps.

To build devices that meet the emerging needs of regulated remote patient care and positively drive patient-provider adoption, there are four principal areas in which manufacturers will need to focus: Distribution, integrity, privacy and adherence. These four areas speak to the changes to the design of the devices, the nature of services these brands provide, and the necessary infrastructure that supports them.

Distribution

The established distribution funnel for medical devices is profoundly broken, and is especially challenging for new product entrants where distribution includes digital device distribution in addition to or instead of physical distribution.

Distribution hurdles are both broad and high and include such obstacles as:

- Cost containment motivated by the consolidation of hospital, alternate-care center, and physician practices

- Buying power and access into group purchasing organizations (GPO)

- “Single brand” policies in network-integrated delivery care networks (IDN)

- And the preference for “sole-source” and “preferred-provider” contracts, that further results in narrowing choice

Together, issues like these contribute to the difficulty many manufacturers experience getting their connected care devices into the hands of patients who want them.

The next generation of integrated medical devices will almost certainly need to incorporate direct-to-consumer over-the-counter (OTC) distribution to address this issue. Some consumer wearables manufacturers have seen the opportunity and are working to produce programs that blend the power of medical-grade performance with the convenience of consumer retail access.

Take, for example, Bose Health division’s Hearphones—a $499 consumer-level, self-fit, conversation-enhancing hearing amplifier that obviates the need for an audiologist (full disclosure, Bose was a previous client). Capitalizing on the launch of their non regulated product, they lobbied for the Over-the-Counter Hearing Aid Act, which was signed into law in 2017, and in 2018 the company was granted De Novo status by the FDA on their in-progress, regulated next-gen hearing aid. In a Fast Company article, John Roselli, general manager of Bose Health, had this to say in regards to the importance of regulated clearances for the future of their medical OTC program: “Even though your product could perform a lot like an FDA-cleared device, if you can’t make a medical claim or make messaging around that in terms of what it does, it becomes really difficult—especially if it’s over-the-counter—to try to reach patients and consumers.”

Integrity

The quality of the data that is collected must be consistent enough to inform medical interventions. In the regulated space, that means meeting a much higher standard of variance control for manufacturing and performance than is necessary for non-regulated devices. Manufacturers must demonstrate to the FDA that these products have sufficient quality controls through a regulatory clearance or approval that backs up functional claims and demonstrates their compliance with regulatory standards. For distribution in a regulated market, this communicates to insurers, physicians and hospital systems that the device and its efficacy claims are real and can be trusted.

This is a non-trivial exercise that, in the worst case, can complicate the operation of revenue-generating aspects of the non regulated business if done wrong. In order to avoid having the entire production ecosystem fall under regulatory review, consumer-grade manufacturers should carefully consider how to set apart their consumer and medical-grade tech and systems.

Without this differentiation, consumer tech companies are marketing health capabilities that are ahead of what their devices can actually, reliably do and will fail to garner the confidence of the medical industry. This has led to healthcare providers being slow to embrace consumer-facing wearables, like Fitbits, Jawbones and Apple Watches, due to a lack of trust or finding relevant uses for the information they provide. To move beyond the confines of mere “wellness” solutions, the data these devices capture must work seamlessly in and out of the clinical environment. That means changes to everything from how the device is designed (i.e., sensor placement, such as in the case of finger vs. wrist for more accurate blood oxygen readings) to how the data is accessed to operate within and be compatible with currently accepted tools and methods of clinical analysis.

Ultimately, the execution will likely also need to be platform play, where an array of different devices can work together, contributing detailed and cross-comparable data that informs clinical decision-making. For example, ResearchKit, HealthKit and CareKit, which are Apple’s combined bid for a framework that intends to both aggregate medical research data and standardize app development. Or Analog Devices’ and LifeQ’s collaboration to develop smart, wearable sensors that provide noninvasive body-monitoring solutions in and out of the clinical environment to aid in ongoing health management.

Privacy

While there will always be a fundamental need for digital privacy and security, people’s inherent trust in the entities they are asked to share their sensitive data with are on a spectrum with utility. The more valuable the potential benefits, the more one is able to mentally negotiate the perceived risks—combined, of course, with the continually improved degrees of protection offered by those same entities.

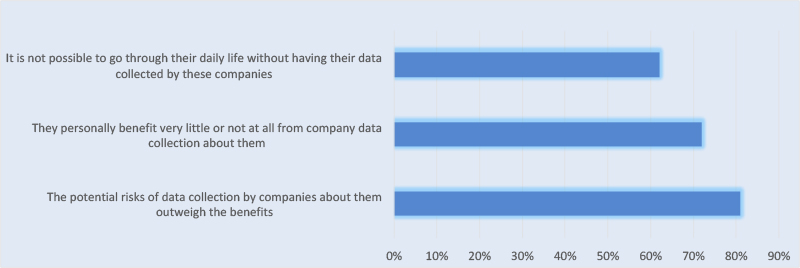

According to a recent Pew Research Center study on digital privacy perceptions, 81% of Americans responded that the potential risks of data that companies collect about them outweigh the benefits. In addition, 72% of adults involved in the study say they “benefit very little or not at all” from company data collection about them. However, 62% believe going through their daily life without having their data collected by these companies is impossible (see Figure).

To build trust, manufacturers will need to develop, maintain and promote data management policies that prioritize adherence to Health Insurance Portability and Accountability Act (HIPAA), the European General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA) guidelines. Risk assessments to determine which data are collected or stored that fall under the definition of “protected” data—particularly those that can be used to identify a person or group of persons—are critical. Healthy privacy policies also necessitate the development and management of a robust end-to-end consent management program for patients and third-parties such as hospitals and clinics.

Adherence

Even the best medical-grade sensors in the world are useless if the devices they are embedded in are not used consistently and properly. Poor medication adherence alone costs the United States more than $100 billion annually in avoidable healthcare spending. Devices by themselves don’t improve outcomes. Better lifestyle integration is key to driving changes in patient compliance—embedding sensors into the sorts of devices people use every day to increase opportunities for passive biometric capture.

To positively drive compliance and achieve the level of lifestyle integration necessary to ensure patient adherence and physician adoption, the medical-grade lifestyle devices must be:

- Self-fitting, allowing the patient to acquire, set up, configure and operate without the aid of a physician or other medically-trained professional

- Passive, doing most of its data collection silently in the background with little to no intervention by the wearer or physician to generate reports, alerts, or user value

- Effective, providing clinically valuable data that can be accessed and absorbed quickly by a physician and downloaded and transferred easily by a non-technically fluent user or patient

- Durable, with a battery and useful service life similar to other personal electronics and accessories and utilize readily available standards for use, such as USB-C, 110v plug, 802.11ac Wi-Fi, and so on

- Natural in appearance, with an aesthetically pleasing form factor that does not plainly look like a “medical appliance” or whose core function is otherwise embedded in a functional object or decorative accessory

Prospective patients and providers will judge the utility and efficacy of this emerging class of OTC medical-grade products on a different level than traditional purpose-built, clinical products.

Remote Patient Care and Medical-Grade Lifestyle Devices: A Powerful Combination

Delivering on all of these dimensions may not be easy. The challenges left to solve may only be the difficult ones—but they are surmountable and the potential is too great to not try. The effort is critical and worthwhile. Health systems and patients will benefit from investing in remote patient monitoring systems and devices. In addition to opening up opportunities for improved and more timely care, there is potential for patient cost savings, too. Removing the obstacle of unnecessary visits and optimizing healthcare provider time spent, should improve outcomes and reduce preventable emergency care down the road. Investment in evolved policies and service models, combined with the convenience of best-of-breed wearable consumer technology is a tide that has the potential to lift all boats.

Of course, the best technology, services and systems in the world are largely ineffective if they are not utilized. Both the patient and care provider must be equally engaged to achieve success. But how?

The next article in this series will delve further into the dimensions of strong engagement, unpack why they are important, and how manufacturers need to augment their design and development programs to build products that successfully engage patients and providers in a virtuous cycle.