Wearable electronic devices such as Apple’s iWatch or the Fitbit have become ubiquitous in advanced economies in the West, and they are catching up in Asia. Wearable medical devices such as electronic cardiogram skin patches, glucose monitors with “smart” alarms, and vital signs sensors, meanwhile, are taking hold across the globe, transforming healthcare by facilitating personalization and convenience. To date, much of the growth in wearable medical devices has occurred in the United States, but with compound annual growth rates upwards of 20%, the market for these devices is beginning to change healthcare in Asia.

In addition to technological advances that make wearable medicine possible, three trends are driving growth in the medical wearables market in Asia:

- Rise in healthcare spending by both governments and individuals

- Jump in the incidence of so-called “diseases of civilization”, including diabetes and heart disease. The World Health Organization estimates that the number of annual cardiovascular events will rise by more than 50% by 2030 in China. And the number of diabetics in India, now at 67 million, will soon surpass the number of cases in China.

- Aging population. Japan expects that more than one-third of its population will be at least 65 years old by 2055, creating additional demand for government-run healthcare facilities.

Together, these developments will push wearable device sales upwards to an estimated 13 million units in Japan by 2017; 1 million units in India by 2016; and a whopping 4.7 billion units in China by 2020, according to companies such as iMedia Research and the International Data Corporation (IDC).

Increasing Consumer Health Consciousness

Asia’s medical device market ranges from from mass-market glucose monitors to high-end diagnostic imaging equipment. Amongst wearable devices, demand for gadgets such as fitness trackers and heart rate monitors is driving much of the growth in Asia. Companies spanning from U.S.-based Fitbit and Jawbone, Japan’s Omron, Spain’s Nuubo and China’s Xiaomi, comprise just a few players in this field. Competition is rising as Asian consumers and corporations pay increasing attention to health and fitness.

The likes of Fitness First, Anytime Fitness and Virgin Active have been rapidly expanding their footprints in the region. Sportswear giants Nike and Adidas are also growing, creating new retail venues for smart sports wearables, including fitness trackers such as Xiaomi’s Mi Band, smart athletic apparel such as the Moticon’s sensor insoles, and muscle fatigue and performance monitors like the Viper Pod.

More novel health-oriented devices are also starting to pepper Asian markets. Xiaomi offers a smart lightbulb that pairs with personal tracking devices to adjust brightness and color, which can help with sleep and mood disorders. In India, Dubai-based Tupelo has released MYMO, a fitness tracker that awards wearers points that can be used to buy items such as groceries when they complete activity goals. Across Asia, sales of mattresses with sensors to screen for snoring, breathing rates and pressure points are on the rise.

Ensuring Employee Wellness

Corporations in the United States and Europe are already incorporating fitness trackers into corporate wellness programs. Asian companies and the region’s growing healthcare outlets are likely to follow. Other devices, such as the posture sensors ‘Darma’, ‘Prana’ and ‘Upright,’ may also appeal to the growing number Asian office workers, as well as to new mothers.

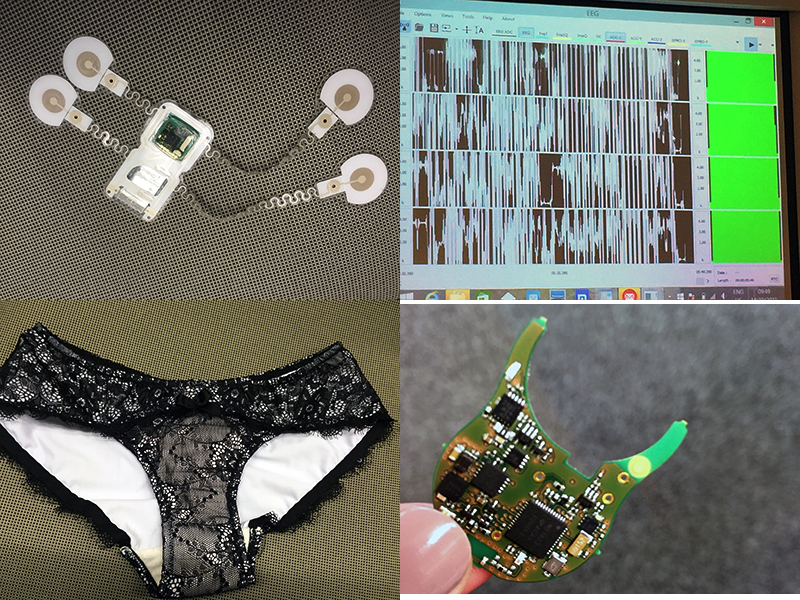

Asia’s healthcare practices already have access to a plethora of wearable medical devices that help manage aging, heart disease, diabetes and fertility. Monitors collect and transmit data on patient vital signs such as blood pressure and respiratory rates; skin patches collect electric signals from the brain and heart, or measure glucose; and positioning and communication systems monitor patient and provider movements.

But there is plenty of room for growth. For example, Boston Consulting Group (BCG) estimates that about $700 million in venture funding poured into digital health care in China in 2014, supporting the development of e-commerce applications, online physician-and-patient communication services, and disease management applications. BCG expects that the market for digital healthcare in China will expand from $3 billion in 2014 to $110 billion in 2020.

Getting in on the Game

While the wearable device revolution traces its origins to U.S. technology companies, Asian manufacturers are getting in on the game with some novel devices. Take Tokyo-and California-based venture, Triple W, for example. The company is working on a wearable device that informs users when they need to urinate. This may appeal to consumers in Japan, where the adult diaper market is expected to surpass the baby diaper market by 2020 due to an aging population. Japan’s Docomo Healthcare offers a device-application combination, Karada-no-kimochi, which links Docomo smartphones to Omron digital thermometers that women can use to track their basal body temperature, which is useful in estimating ovulation dates.

In China, device manufacturing ranges from Fudan’s proprietary wireless ECG patch, to a set of a set of chopsticks, designed by internet search engine giant, Baidu, that tests food and water for contamination. In South Korea, the startup company YBrain is working on a headband that passes currents to the brain to help alleviate symptoms of Alzheimer’s disease. And Indian researcher Srinivasan Murali, co-founder and CEO of the Switzerland-based SmartCardia, is working on a device called The Inner You (INYU) that tracks physical and emotional data, such as stress levels.

Challenges and Opportunities for Western Companies in Asia

The field for medical devices in Asia is changing so rapidly that regulators and companies are struggling to keep up. In addition to meeting typical regulatory requirements for medical devices, wearable medical devices may face additional product safety and environmental requirements, reimbursement issues, and post-market surveillance. Some wearable devices may cause burns or electric shocks, or transmit electric signals, for example. In addition, extensive clinical studies may be required to back up the medical claims for wearable devices.

The upshot of the wearables trend is that the playing field for Asia’s wearable medical devices is simultaneously becoming more crowded and more complicated. To compete effectively, U.S. and European manufacturers can leverage technology to develop more specialized and personalized devices. We may see companies develop medical wearables made smarter by tailoring their features more specifically to different market segments, including the elderly or young diabetics. Manufacturers may also consider forging partnerships with large corporations, healthcare practices and retailers to expand market reach. While the market for wearable medical devices is increasingly competitive, it remains a fluid and growing field of attractive opportunities for the foreseeable future.