Ongoing Threat of Infectious Diseases in Asia

Populations across Asia have enjoyed substantial improvements in healthcare in recent decades: infant mortality rates have dropped by more than two-thirds in East Asia; governments in China, the Philippines, Malaysia, and Indonesia have dramatically increased healthcare spending; and a growing number of people throughout the region are gaining access to affordable healthcare. Despite this progress, Asia continues to confront threats from infectious diseases.

Infectious diseases are a significant health concern in Asia due to high population density, poor prevention education, lack of funding, and various environmental factors. The World Health Organization estimates that infectious diseases are responsible for more than half of all child mortality in Asia. Pneumonia kills about 2,500 children a day worldwide, with high prevalence in South Asia and China. Tuberculosis and sexually transmitted diseases are also rampant in China, India and parts of Southeast Asia. The reemergence or persistence of diseases, including measles, polio and mumps, present an ongoing threat, and the Chinese government recently declared HIV and AIDS a mild “pandemic”. All these trends are compounded by the fact that increased anti-microbial resistance resulting from overuse of antibiotics is making more people susceptible to communicable diseases.

Policy makers throughout Asia have made tackling the spread of infectious disease a priority. At its 2015 annual meeting, the Asia-Pacific Economic Cooperation (APEC) committed to building capacity to “effectively prevent, detect and respond to infectious disease” by inviting private sector contributions. Governments in China, Singapore, Indonesia and Malaysia are funneling investment into infectious disease research. As a result, regional hospitals, clinicians, and research centers are increasingly demanding more sophisticated medical devices to detect and manage preventable diseases such as HIV and AIDS, malaria, hepatitis and tuberculosis.

According to research group Markets and Markets, the infectious disease diagnostics market is growing at compound annual rates as high as 9% in Asia, in response both to rising demand from the healthcare industry and rising incomes. Globally, Markets and Markets estimates that the diagnostic market will reach $18 billion in 2019. Asia is also the fastest growing market for vaccines—with growth rates also reaching 9%—as governments expand prevention programs and new types of vaccines are introduced to the market.

Many diagnostic device manufacturers, such as Roche, Abbott Diagnostics, Novartis, Alere, and Becton Dickinson, derive an increasing proportion of their revenues from Asia, even as the number of local devices makers rises. Advances in technology have helped to spur activity in Asia’s medical device market, as companies pursue innovative methods to confront infectious diseases.

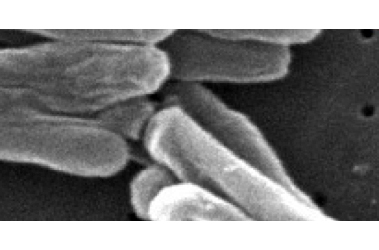

Some device manufacturers are focusing on devices that can identify the type of bacteria causing an infection, in an effort to reduce the unnecessary use of antibiotics that is fueling a global rise in drug-resistant bacterial infections. Roche spent $425 million last year to buy GeneWeave Biosciences, which developed a diagnostic technology called Smarticles to rapidly identify the bacteria causing an infection and determine which, if any, antibiotics can be used to treat it. Belgium’s Biocartis Group has recently released a diagnostic test using multiplex polymerase chain reactions that can identify which of 20 potential viruses and bacteria are causing a respiratory infection within 50 minutes. Biocartis also recently signed an agreement with India-based Fast-track Diagnostics to develop a range of multiplex tests for infectious diseases.

Western researchers are also developing new types of clinical analyzers, which historically have been cost prohibitive for many developing countries. For example, a team at the University of Texas at El Paso patented a new inkjet printer device that uses magnetic particles to detect infection-fighting cells from a blood sample to help HIV patients monitor symptoms. Researchers from the University of Illinois at Urbana-Champaign developed a biosensor to electrically count different types of blood cells based on their size and membrane properties. This can be performed at the point-of-care using only 11 microliters of blood.

A type of product that is likely to appeal to Asian markets is a micro-kit using samples of bodily tissue or fluids together with RNA/DNA extraction and molecular diagnosis processes that cuts the time and costs typically incurred to detect infectious diseases (developed by the Singapore Institute of Bioengineering and Nanotechnology). In Taiwan, scientists are developing a paper-based test using gold nanoparticles to quickly detect tuberculosis. And researchers at the Massachusetts Institute of Technology have developed a technology using silver nanoparticles functionalized to target infectious agents that requires no electricity, cold storage, specialized reagents, or other infrastructure, making it a potentially ideal platform for field work in resource-constrained environments.

Other inventions include devices that allow patients and doctors to monitor disease progression, even remotely via smartphones. In the UK, Biosure recently released a HIV self-test that retails in the UK for £30 (but is not yet available in Asia). Researchers at Columbia University and in Singapore separately have also developed mobile devices allowing users to detect HIV and syphilis in less than 15 minutes.

Innovative technologies are helping governments, companies and healthcare practitioners in Asia meet growing demand for medical devices to help manage infectious diseases. While the market is increasingly competitive, the range of devices available to manage infectious diseases will serve Asia’s diverse population well.